When German engineering and technology company Bosch inaugurated a new semiconductor plant in Dresden, Germany, earlier this year, it received large local media coverage as state-of-the-art chip production facilities are few and far between across the EU.

“Our semiconductor facility in Dresden is Bosch’s first AIoT factory, combining artificial intelligence (AI) with the Internet of Things (IoT),” Bosch spokesperson Annett Fischer told DW back in July, pointing out that the plant would provide specialized chips for the automotive sector.

Technology expert Jan-Peter Kleinhans from the Berlin-based think tank Stiftung Neue Verantwortung (SNV) recently spoke of “a state-of-the-art facility for power electronics for the automotive portfolio Bosch has been specializing in.”

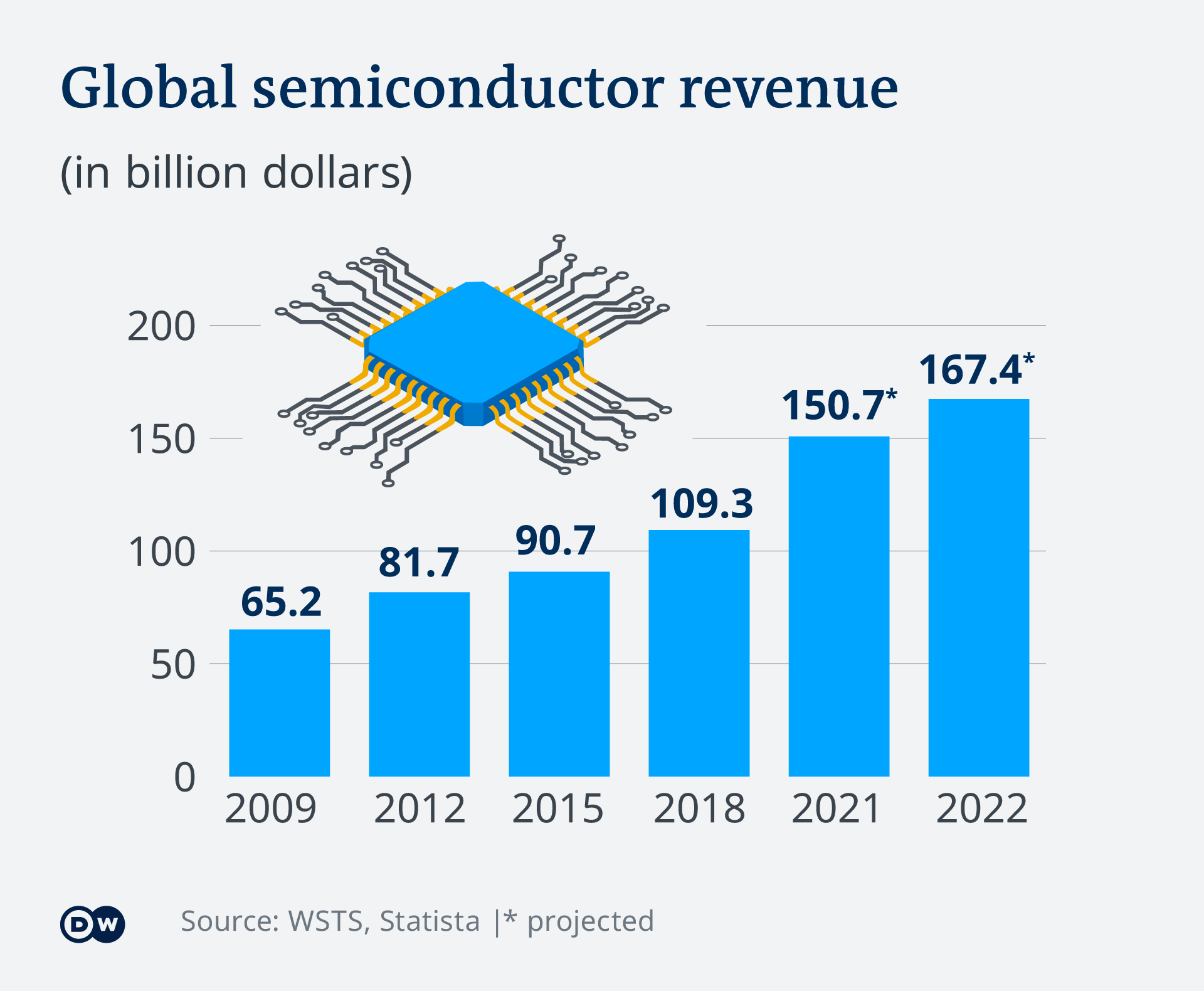

All in all, though, the Bosch plant was little more than a drop in the semiconductor ocean.

Supply chain snarls

Toward the end of the year, European economies appear to be among those worst hit by a global chip shortage that’s still severely impacting production flows.

Carmakers had to postpone vehicle deliveries. Internet routers turned into scarce items and so did gaming consoles and a lot more items that depend so heavily on semiconductors.

When it comes to chips for the consumer electronics sector, Europe is even more dependent on overseas suppliers. “We cannot hold a candle to the US, China and other competitors when talking about smartphones, laptops or cloud data centers — almost none of those come from European players,” Kleinhans told DW.

Lessons to learn

He and China analyst John Lee, who until recently was with the Mercator Institute for China Studies (MERICS), have co-authored an analysis on what Europe’s answer to China’s rise in semiconductors should be. There they formulated recommendations for policymakers on how to soften the impact of China’s growing clout in the chip industry on EU economies.

The European Commission is certainly aware of the recent chip supply bottlenecks and its far-reaching implications and is working on the European Chips Act, a draft of which should be ready by the middle of next year. A lot of money is to be earmarked for strengthening the EU’s chip ecosystem and forging strategic alliances with international partners to achieve this goal.

Europe’s share across the whole chip value chain has been decreasing lately, including design and manufacturing capacity, relative to the growing capabilities of other nations. Brussels fully understands that depending too much on semiconductors from China and other major players can severely impact the EU’s tech sovereignty.

What makes the EU’s ties with China so complicated is that while still being a cooperation partner, China is more and more seen as a competitor and systemic rival, meaning that dependencies can also involve crucial security issues.

Why chip design is key

In their December report, Kleinhans and Lee strongly advise European policymakers to encourage more investments in the bloc’s chip design ecosystem, “focusing on improving conditions for startups and spin-offs from research institutions,” while also demanding better and faster access to funding, private and public equity.

“We don’t speak about a race with China in the report, or catching up with China — we’re talking about rebalancing,” Lee told DW.

“The issue is not overtaking the Chinese in chip design, because that’s not going to happen. Europe does not have the ecosystem for it that the Chinese already have, but what we’re advocating for is mitigating dependence and potential risks from overly relying on the Chinese semiconductor ecosystem.”

The report singles out chip design as the step in semiconductor production with the highest value added and hence the biggest proportionate revenue generator. Design requirements are on the rise as demands on transistors increase with a view to implementing more functionality, making them more secure and enabling them to remain in service longer. Tuning them for specific end applications also plays an important role.

The problem with outsourced back-end manufacturing

Kleinhans and Lee also highlight the current imbalance in the final step of the semiconductor value chain that’s come to be called back-end manufacturing, involving the assembly, testing and packaging of chips.

Silicon wafers contain many tiny integrated circuits that need to be cut out and protected from damage by encapsulating them before soldering them into devices such as smartphones. The process is labor-intensive and has been mostly outsourced to Asia, with over 60% of global capacity based in Taiwan and China as the report points out. Increasingly, though, advanced packaging is crucial to developing chips with a higher performance and lower energy requirements.

Only about 5% of that back-end manufacturing capability is located in Europe, creating yet another dependence on China and other Asian competitors.

“Advanced packaging is one area on which the industry leaders in China and elsewhere are focusing heavily at the moment as an alternative way of increasing computing power,” Lee emphasized. “So, packaging is becoming a much more significant element of the value chain than it was five or six years ago.”

Apart from losing out on revenues, Europe’s excessive outsourcing to China in the advanced packaging segment also comes with a potential security risk.

Producing more wafers in Europe itself is certainly a worthwhile effort, but if those wafers are then sent to China for assembly, testing and packaging, potential malicious actors could compromise the chips. Packaging processes provide an attack vector to implement a kill switch or hardware backdoor that would be harder to detect than a software exploit.

This is certainly something that EU policymakers cannot afford to ignore when working on the bloc’s European Chips Act.

Edited by: Tim Rooks

Chip design matters for EU, but so does packaging

Source: Pinoy Pop News

0 Comments